Content

- Profitability Despite Lack of Knowledge- Drawbacks of Utilizing Absorption Costing

- How to Calculate the Total Manufacturing Cost in Accounting

- Summary – Absorption Costing vs Activity Based Costing

- Percentage of Direct Material Cost

- Step 1. Assign Costs to Cost Pools

- Full absorption costing — accounting changes

- Absorption Costing Components

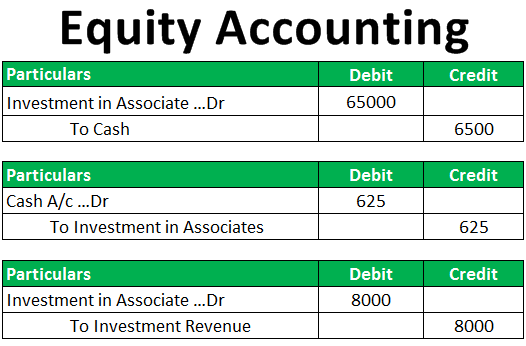

Unfavorable manufacturing standard cost absorption variances arise when the costs incurred exceed the total budgeted manufacturing costs. This can happen for several reasons, such as unexpected increases in raw materials prices or unanticipated production problems. Assigning costs involves dividing the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assigning overhead costs to produced goods based on this usage rate. Absorption costing is a means of incorporating a fair share of indirect cost or overheads into the cost of a unit of product or service provided.

The prime cost, comprising direct materials, direct labor, and direct expenses, is significant in every type of organization. The distribution of the accumulated overhead cost of a production department amongst its cost units is known as overhead absorption. Activity-based costing, also known as ABC, is an accounting method that identifies a company’s activities and assigns costs to units produced by the company based on the number of activities used by each unit.

Profitability Despite Lack of Knowledge- Drawbacks of Utilizing Absorption Costing

So, we have the ability, therefore, to work out the overheads that will be absorbed over the course of this financial period. The actual machine hours worked in the period were 21,000, and we multiply that by department A’s overhead absorption rate, which we’ve worked out previously to be $20 per machine hour. Now, that would give us an overhead absorbed of $420,000, which is what we have in our management accounts at the moment. So, when we’re working out the overhead absorption rate for department B, we’re actually going to use the budgeted level of activity for labour hours, which is 4,000.

- Then we make this comparison between the overhead absorbed and the actual overheads, and that allows us to work out overhead over or under absorption.

- We will use the UNITS SOLD on the income statement (and not units produced) to determine sales, cost of goods sold and any other variable period costs.

- Fixed manufacturing overhead costs are indirect costs and they are absorbed based on the cost driver.

- However, the managers prefer marginal costing over absorption costing for managerial decision-making.

- You need to allocate all of this variable overhead cost to the cost center that is directly involved.

- This possibility is contingent on factors such as the nature of an enterprise’s operations and the industry’s standard practice.

On the other hand, marginal costing ignores fixed costs altogether, which means that all products appear to be equally profitable. Because absorption costing does not allow for the deduction of fixed expenses from revenue until after the units have been sold, it provides inaccurate information on the amount of money the firm makes. The corporation’s income statement may indicate unaccounted-for costs, but the balance sheet would indicate that the company is profitable. When determining a product’s total cost, absorption pricing considers all aspects of production that contribute directly to that cost. Absorption pricing considers variable and fixed overhead expenses when calculating product prices. The difference between absorption costing and variable costing is that absorption costing assigns fixed overhead expenses to each product unit produced throughout the period.

How to Calculate the Total Manufacturing Cost in Accounting

Once we’ve calculated the overhead absorption rates, we can then go through the process of absorbing overheads. This is nothing more than trying to build up an estimated cost of making our products. For department A, that will give us an overhead absorption rate of $20 per machine hour. It’s a machine intensive department so we’ll divide that by the 20,000 machine hours which will give us the rate of $20 per machine hour. The cost of absorbing each unit is seven dollars ($5 for labor and materials, plus $2 for fixed overhead expenditures). As a result of selling 8,000 widgets, the total cost of goods sold is $56,000 ($7 total cost per unit multiplied by the number of widgets sold).

Since absorption costing requires the allocation of what may be a considerable amount of overhead costs to products, a large proportion of a product’s costs may not be directly traceable to the product. This is a straightforward and simple method of cost allocation but, some accounting and business practitioners question whether such an approach can produce accurate financial results. One of the main drawbacks in traditional costing systems such as absorption costing or variable costing occurs with the method of allocating fixed and variable overheads. Also known as full costing, absorption costing is an accounting method in which all manufacturing costs are absorbed by the units produced by a given company. We’re asked to work out the over or under absorption for department A, if the actual machine hours for the period were 21,000 and the actual overheads were $415,000. We determined that it was machine intensive, and we’d already worked out department A’s overhead absorption rate being a particular rate per machine hour.

Summary – Absorption Costing vs Activity Based Costing

Absorption costing can skew a company’s profit level due to the fact that all fixed costs are not subtracted from revenue unless the products are sold. By allocating fixed costs into the cost of producing a product, the costs can be hidden from a company’s income statement in inventory. Hence, absorption costing can be used as an accounting trick to temporarily increase a company’s profitability by moving fixed manufacturing overhead costs from the income statement to the balance sheet. It is also possible that an entity could generate extra profits simply by manufacturing more products that it does not sell. Let’s say a company manufactures 10,000 units of a particular product with a cost per unit of $10 in direct materials, $8 in direct labor, and $2 in variable manufacturing costs. Let’s say the company also has fixed manufacturing overhead costs totaling $40,000 per year.

The total cost incurred can be divided by the number of units produced to arrive at the unit cost of production. Absorption costing takes into account both fixed and variable costs; thus, this approach is also referred to as ‘full costing’. First, it is vital to clearly understand the concept of absorption costing. This accounting method assigns both direct and indirect costs to products or services.

Percentage of Direct Material Cost

Absorption is not required if an organization does not use standard costing. However, absorption costing has certain benefits, such as more accurate tracking of fixed costs and a better understanding the cost of goods sold. Additionally, absorption costing can provide valuable information for management decision-making. When absorption costing is used, the expenditures that appear on the income statement are reduced. This is because more expenses are included in the inventory total at the end of the period. For financial reporting and taxation purposes, we think that the typical production costs, including those related to materials, labor, and administrative expenses, should be included in inventory costs.

It’s a very simple approach to absorb overheads into cost units; very simple in that it’s not overly detailed, it’s not overly complex. For each department we look at, we need to decide whether they are labour intensive or machine intensive. We work out an overhead absorption rate, and once we’ve got that we’ve got a nice simple mechanism to help us work out the estimated full production cost per unit for our products. Absorption costing affects the income statement by changing the amount of cost of goods sold and gross profit. Under absorption costing, cost of goods sold depends on the number of units sold, not on the number of units produced. This means that if the number of units sold is less than the number of units produced, some of the fixed manufacturing overhead will remain in the inventory and will not be expensed.

Step 1. Assign Costs to Cost Pools

Experts are adding insights into this AI-powered collaborative article, and you could too. Overhead Absorption is achieved by means of a predetermined overhead abortion rate. Once you complete the allocation of these costs, you will know where to put these costs in the Income Statements. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

Therefore, it becomes necessary to charge overheads to the cost of products, jobs, and processes according to certain well-established norms and scientific reasoning. However, the managers prefer marginal costing over absorption costing for managerial decision-making. The total production overhead absorbed, therefore, is $65 across the two departments. This helps to https://kelleysbookkeeping.com/ guarantee that the product’s pricing is reasonable concerning the costs incurred during manufacture. Additionally, it ensures that the prices of the items are accurate and in line with those of their competitors. It is crucial to remember that both fixed and variable selling and administration costs are considered period costs and expensed in the period they occur.

Full absorption costing — accounting changes

Variable overhead costs directly relating to individual cost centers such as supervision and indirect materials. You need to allocate all of this variable overhead cost to the cost center that is directly involved. Higgins Corporation budgets for a monthly manufacturing overhead cost of $100,000, which it plans to apply to its planned monthly production volume of 50,000 widgets at the rate of $2 per widget. In January, Higgins only produced 45,000 widgets, so it allocated just $90,000. The actual amount of manufacturing overhead that the company incurred in that month was $98,000.

- The organization also receives an accurate image of its profitability via the absorption costing method.

- Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

- In this method cost is absorbed as a percent of the labour cost or the wages.

- E.g. In the above example, if shipping costs are allocated based on the number of labor units, it is not justifiable since it is not labor intensive and shipping charges are based on the number of units shipped.

- The main criticism of absorption costing is that it does not provide accurate information for pricing decisions.

- Absorption costing provides a poor valuation of the actual cost of manufacturing a product.

- To apply predetermined absorption rates, the actual value (i.e., the actual number of units or any other actual base data such as direct labor hours or machine hours) is multiplied by the predetermined rate.

Under the absorption costing method, the overhead expenses that are not directly related to the product are distributed over all units. Fixed manufacturing overhead costs are indirect costs and they are absorbed based on the cost driver. Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines. Once again, we’ve got the expected time in terms of machine hours Total Absorption Costing and labour hours for Product X in department B, but the most important thing is our overhead absorption rate is $25 per labour hour. So, when we’re absorbing department B’s overheads into Product X, we have to pay attention to the labour hours per unit and in this case, that’s one labour hour. Absorption costing includes all manufacturing costs in goods sold (COGS), while marginal costing only includes direct materials and labor.